You buy the right to use a specific unit at a specific time every year, and you may lease, sell, exchange, or bequeath your specific timeshare system. You and the other timeshare owners jointly own the resort home. Unless you've purchased the timeshare outright for money, you are accountable for paying the regular monthly mortgage.

Owners share in the use and maintenance of the systems and of the typical grounds of the resort property. how to sell wyndham how much does timeshare exit team cost timeshare. A homeowners' association usually deals with management of the resort. Timeshare owners choose officers and manage the expenditures, the maintenance of the resort home, and the selection of the resort management business.

Each apartment or system is divided into "intervals" either by weeks or the comparable in points. You buy the right to utilize a period at the resort for a specific number of years usually between 10 and 50 years. The interest you own is legally thought about personal effects. The specific unit you use at the resort might not be the very same each year.

Within the "right to use" alternative, several plans can timeshare floating week impact your ability to utilize an unit: In a fixed time alternative, you purchase the system for use throughout a particular week of the year. In a floating time choice, you utilize the system within a certain season of the year, scheduling the time you desire ahead of time; verification normally is provided on a first-come, first-served basis.

You use a resort system every other year. You occupy a part of the system and provide the staying space for rental or exchange. These systems usually have 2 to 3 bedrooms and baths. You buy a specific number of points, and exchange them for the right to use an interval at one or more resorts.

In computing the total cost of a timeshare or getaway strategy, consist of mortgage payments and costs, like travel expenses, annual maintenance costs and taxes, closing costs, broker commissions, and finance charges. Maintenance charges can increase at rates that equal or surpass inflation, so ask whether your plan has a charge cap.

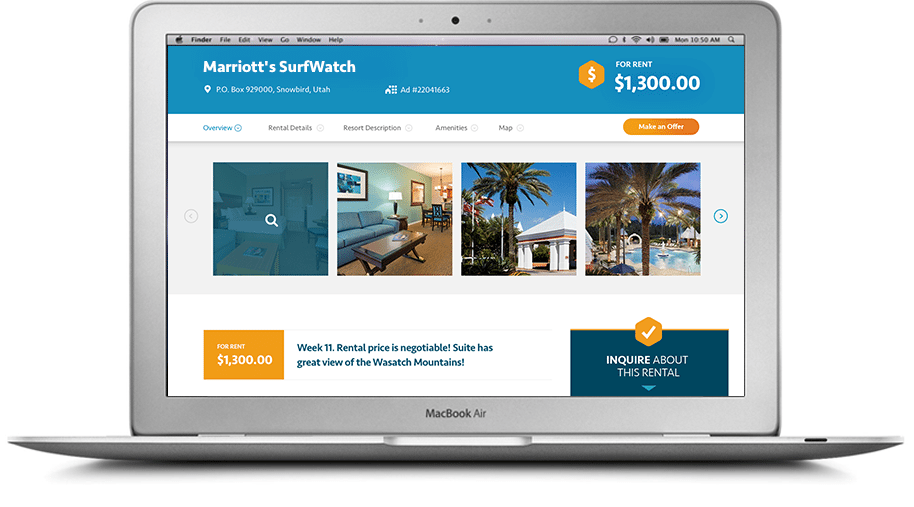

To assist examine the purchase, compare these expenses with the cost of renting comparable lodgings with comparable facilities in the very same place for the same period. If you discover that buying a timeshare or vacation strategy makes sense, window shopping is your next step (how to purchase time share sales jobs a timeshare). Evaluate the area and quality of the resort, in addition to the availability of units.

What Is The Average Cost To Get Out Of A Timeshare for Dummies

Local property representatives also can be excellent sources of details. Look for complaints about the resort developer and management company with the state Chief law officer and regional consumer defense authorities. Research study the track record of the seller, developer, and management company before you buy. Request a copy of the present maintenance spending plan for the residential or commercial property.

You also can search online for complaints. Get a handle on all the commitments and advantages of the timeshare or getaway strategy purchase. Is everything the salesperson assures written into the agreement? If not, walk away from the sale. Do not act on impulse or under pressure. Purchase incentives might be used while you are touring or remaining at a resort.

You can get all pledges and representations in writing, in addition to a public offering statement and other relevant documents. Study the documentation outside of the discussion environment and, if possible, ask somebody who is well-informed about contracts and realty to examine it before you make a decision.

Ask about your ability to cancel the contract, in some cases described as a "right of rescission." Numerous states and perhaps your contract give you a right of rescission, however the amount of time you have to cancel might differ. State law or your contract also might specify a "cooling-off period" that is, for how long you have to cancel the offer as soon as you've signed the documents.

If, for some factor, you choose to cancel the purchase either through your agreement or state law do it in composing. Send your letter by qualified mail, and request for a return invoice so you can record what the seller got. Keep copies of your letter and any enclosures. You should receive a timely refund of any cash you paid, as offered by law.

That's one method to assist secure your contract rights if the developer defaults. Make certain your contract includes stipulations for "non-disturbance" and "non-performance." A non-disturbance provision ensures that you'll have the ability to utilize your unit or period if the developer or management company goes bankrupt or defaults. A non-performance provision lets you keep your rights, even if your contract is purchased by a third celebration.

Watch out for deals to purchase timeshares or getaway plans in foreign nations. If you sign a contract outside the U.S. for a timeshare or holiday plan in another nation, you are not safeguarded by U.S. laws. An exchange enables a timeshare or trip plan owner to trade units with another owner who has an equivalent system at an affiliated resort within the system.

How To Get Out Of Westgate Timeshare - The Facts

Owners become members of the exchange system when they purchase their timeshare or holiday plan. At a lot of resorts, the designer spends for each new member's first year of membership in the exchange company, but members pay the exchange business directly after that. To take part, a member must transfer an unit into the exchange business's inventory of weeks offered for exchange.

In a points-based exchange system, the interval is immediately taken into the stock system for a specified period when the member joins. Point values are appointed to systems based on length of stay, location, unit size, and seasonality. Members who have adequate indicate secure the trip accommodations they want can reserve them on a space-available basis.

Whether the exchange system works sufficiently for owners is another problem to look into prior to buying. Remember that you will pay all charges and taxes in an exchange program whether you use your unit or somebody else's. Timeshare Resale ScamsInfographic If you're thinking about offering a timeshare, the FTC warns you to question resellers property brokers and agents who focus on reselling timeshares.

Some may even state that they have buyers prepared to buy your timeshare, or promise to offer your timeshare within a particular time. If you wish to sell your deeded timeshare, and a business approaches you offering to resell your timeshare, go into skeptic mode: Don't accept anything on the phone or online until you have actually had an opportunity to have a look at the reseller.

Ask if any complaints are on file. You also can browse online for problems. Ask the sales representative for all details in writing. Ask if the reseller's representatives are licensed to sell property where your timeshare lies. If so, confirm it with the state Real Estate Commission. Offer just with licensed real estate brokers and representatives, and ask for referrals from pleased clients.